Who we are

Paradigm is a social enterprise company focused on developing inclusive residential housing communities for people with intellectual and developmental disabilities (IDD) and other neurotypical individuals..

Our Vision

Through Paradigm Development, we are building integrated living communities that offer affordable housing options and long-term solutions for families and individuals with IDD and other neurotypical individuals..

Paradigm will also work with disability service providers (DSPs) to ensure residents can access all the services they need to live happy, independent lives.

Menu

The Opportunity:

Lack of affordable housing is a crisis in the United States.

In Cincinnati and Indianapolis (the initial markets for our fund), it’s estimated that there is a combined shortage of nearly 70,000 homes.

The problem is more acute for people with intellectual and developmental disabilities. They face housing challenges on multiple fronts:

- Affordable housing is scarce. Low-income housing tax credit apartments and Section 8 housing are limited, and most market rate apartments are unaffordable.

- Even if people with IDD can find affordable housing, it typically lacks access to critical services and transportation and may be in unsafe areas.

- Communities designed specifically for IDD residents, such as licensed group homes or small apartment complexes, have very limited capacity and wait lists that can run for 10+ years.

Our Solution:

Paradigm Development is building affordable housing for people with IDD and other neurotypical individuals in Indianapolis and Cincinnati and other select markets.

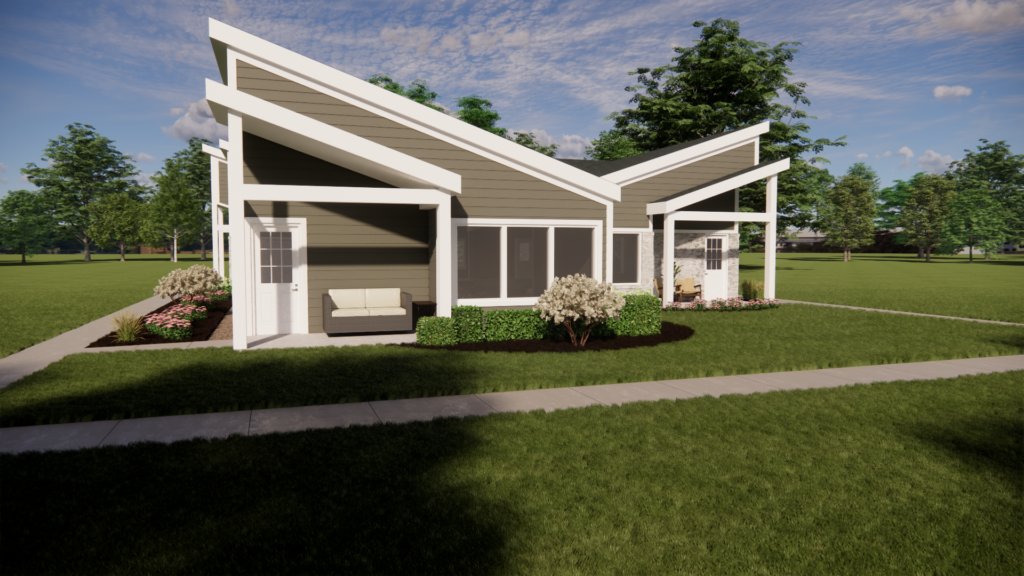

Paradigm will primarily build, develop and/or renovate one and two-bedroom residential units ranging in size from 500 – 1,200 sq. ft. with a majority being resident-owned.

Our Housing Vertical

8-10+ Units: Clustered single-family or duplex homes developed in strong economic neighborhoods, near disability service organizations and community living.

20-30+ Units: Small residential communities or buildings with a mix of condominiums, townhomes, single-family / micro homes, and a clubhouse / community center for socialization.

40-60+ Units: Larger mixed-use and residential communities or buildings consisting of on-site adult day programs, clubhouse / community center, and a mix of residential condominiums, townhomes, single-family, micro-homes, and duplexes.

DISABILITY SERVICE PROVIDERS

Paradigm is working with several disability service providers in Cincinnati and Indianapolis. These organizations are truly making an impact in the lives of individuals with intellectual & developmental disabilities (IDD) and helping them to live their best lives. They provide services on a daily and weekly basis, including – transportation, workforce training, adult day programs, socialization / events, and more.

Access to such services is a critical aspect of any successful housing development.

Paradigm is working with Metzcor and the Ken Anderson Alliance, who are leading disability service providers that help to ensure that residents have reliable and consistent access to services.

$1,000,000

Raised

0

Investors

Offering Expires in:

Offering Terms

$5,000,000

Maximum Offering

$500,000

Minimum Offering

$50,000

Minimum Investment

$100.00

Unit Price

Use of Proceeds:

Based on the maximum amount of $5,000,000 is raised.

60%

3,000,000

Hard Costs

14%

$700,000

Land Costs

12%

$600,000

Soft Costs

4.5%

$225,000

Pre-Development Costs / Due Diligence

4%

$200,000

Site & Civil

2%

$100,000

Architecture

1.5%

$75,000

Earnest Money Deposits

1%

$50,000

Asset Management

1%

$50,000

General Administrative

60%

3,000,000

Hard Costs

14%

$700,000

Land Costs

12%

$600,000

Soft Costs

4.5%

$225,000

Pre-Development Costs / Due Diligence

4%

$200,000

Site & Civil

2%

$100,000

Architecture

1.5%

$75,000

Earnest Money Deposits

1%

$50,000

Asset Management

1%

$50,000

General Administrative

Why Invest?

We are vertically integrated. Paradigm has an:

- In-house architect

- Development team

- Construction company

- Property management companies

As a one stop shop, we have the in-house resources to efficiently build and develop projects in a timely manner.

We have integral relationships with disability service providers already in place and the due diligence expertise to evaluate new relationships.

We have significant track records in fundraising, building, and community development.

As a team, we can leverage our ties to the NFL and its fans to help raise awareness and our existing relationships with key service providers.

This is an urgent problem that requires immediate action.

We provide critically needed housing that can be paid for using vehicles (such as a Special Needs Trusts) that do not jeopardize access to government benefits.

Terms

PARADIGM DEVELOPMENT FUND I, LLC is offering for sale up to 70,000 Class C Member Interests (including Bonus Units based on the size of the investment by Investors. Consideration for the Investor Units of the Company is payable in cash upon subscription. This offering is only open to prospective accredited investors. The minimum investment for the Investor Units is $50,000; provided, however, the Manager may, in its sole discretion accept investments less than the stated minimum.

The Manager has the authority and discretion to enter into personal loan guarantor agreements with one or more individuals or entities to secure debt financing for the Company’s real estate acquisitions, development, and construction projects (“Loan Guarantor Agreements”). The Loan Guarantor Agreements may require the Company to compensate the guarantor. Please reference the Offering Memorandum for the loan guarantee structure and allocations.

The Company anticipates distributions of profits to its Members from time-to-time pro rata pursuant to the member’s ownership interests as set forth in the Company Agreement. Distributions to made in the following order of priority:

- First, distribution of the non-compounding, cumulative preferred return of seven percent (7%) per annum to Class C Unit Holders (and pari passu with Class A Investor Units based on capital raised and invested);

- Next, with respect to further and Average Annualized Returns (AAR) in excess of 7%+ and distributions being allocated – seventy percent (70%) to Class C Unit Holders in proportion to equity capital invested; (pari passu with Class A Investor Units based on capital raised and invested); and thirty percent (30%) to Class B Unit Holders.

The non-compounding, cumulative preferred return is based on the invested Capital or adjusted Capital (as Class C Unit Holders are repaid their capital through distributions). Therefore, once the adjusted Capital has been fully repaid, there is no more preferred return.

If there is any sale of Properties, liquidation, dissolution, or winding up of the LLC, either voluntary or involuntary (“Capital Event”), each Investor Unit Holder will be entitled to receive, prior and in preference to any distribution to the Class B Unit Holders of the Company:

- First, (after closing costs and fees associated with the Capital Event), to the Class C Unit Holders until their entire respective accrued preferred return has been paid; (and pari passu with Class A Investor Units based on capital raised and invested);

- Second, to the Class C Unit Holders (and Class A) in proportion to the portion of respective “Unrecovered Capital Contribution” of each which have not been repaid and until each Member’s capital contribution has been repaid in full. “Unrecovered Capital Contribution” shall be calculated as a Member’s Capital Contribution less any prior distributions of capital; (and pari passu with Class A Investor Units based on capital raised and invested);

- Finally, with respect to further excesses seventy percent (70%) to Class C Unit Holders; (and pari passu with Class A Investor Units based on capital raised and invested); and thirty percent (30%) to Class B Unit Holders in proportion to the respective Sharing Ratios.

The non-compounding, cumulative preferred return is based on the invested Capital or adjusted Capital (as Class C Unit Holders and Class A Unit Holders are repaid their capital through distributions). Therefore, once the adjusted Capital has been fully repaid, there is no more preferred return.

Distributable income from a refinance, or supplemental loan will be distributed to the members as soon as practicable after such event, in the following manner and order of priority as follows:

- First, (after closing costs and fees associated with the refinance), to the Class C Unit Holders in proportion to the portion of respective “Unrecovered Capital Contribution” of each which have not been repaid and until each Member’s capital contribution has been repaid in full. “Unrecovered Capital Contribution” shall be calculated as a Member’s Capital Contribution less any prior distributions of capital; (and pari passu with Class A Investor Units based on capital raised and invested);

- Second, to the Class C Unit Holders until their entire respective accrued preferred return has been paid; (and pari passu with Class A Investor Units based on capital raised and invested);

- Finally, with respect to further excesses seventy percent (70%) to Class C Unit Holders; (and pari passu with Class A Investor Units based on capital raised and invested); and thirty percent (30%) to Class B Unit Holders in proportion to the respective Sharing Ratios.

The non-compounding, cumulative preferred return is based on the invested Capital or adjusted Capital (as Class C Unit Holders are repaid their capital through distributions). Therefore, once the adjusted Capital has been fully repaid, there is no more preferred return.

Bonus Units

All Investors will be eligible to receive the number of Class C Bonus Units corresponding to the increments described in the following table. The maximum number of Class C Bonus Units that may be issued is at the discretion of the Manager, up to 70,000 Class C Units.

Bonus Units

75

$50,000 - $99,900 Investment

Bonus Units

175

$100,000 - $249,900 Investment

Bonus Units

625

$250,000 - $499,900 Investment

Bonus Units

75

$50,000 - $99,900 Investment

Bonus Units

175

$100,000 - $249,900 Investment

Bonus Units

625

$250,000 - $499,900 Investment

Bonus Units

1,375

$500,000 - $749,900 Investment

Bonus Units

2,250

$750,000 - $999,900 Investment

Bonus Units

3,250

$1,000,000 + Investment

Bonus Units

1,375

$500,000 - $749,900 Investment

Bonus Units

2,250

$750,000 - $999,900 Investment

Bonus Units

3,250

$1,000,000 + Investment

Management:

Ted Karras

Ted Karras, a Principal and sponsor of the company, serves as a Managing Member of the Manager (Paradigm Real Estate Management, LLC). In addition to his role in real estate management, Ted is a two-time Super Bowl champion NFL football player & the 2023 Walter Peyton Man of the Year fan vote winner, garnered over 1.5+ million votes for his philanthropic work through his Cincy Hat campaign. He has played with the New England Patriots, Miami Dolphins, and currently the starting center on the Cincinnati Bengals. Engaging in real estate acquisition and development since 2019, Ted has established himself as a successful businessman. His residential portfolio includes over 30 properties in the greater Indianapolis, IN area. Ted holds a Bachelor’s degree in Communication from the University of Illinois and an MBA in Business from the Indiana Kelley School of Business. Residing in Cincinnati, Ohio, and Fort Lauderdale, Florida, Ted is married to his wife Rachel.

Zach Douglas

Zach Douglas is a Principal and sponsor of the company, along with being a Managing Member of the Manager (Paradigm Real Estate Management, LLC). He is a devoted family man, visionary entrepreneur, and passionate sports enthusiast. Raised in Indianapolis with strong Midwestern and Catholic roots, Zach graduated in 2011 from Indianapolis Cathedral High School and earned a degree in Finance and International Business from Indiana University’s Kelley School of Business. With experience at Merrill Lynch and later Capital Group, a global investment management company, Zach ventured into real estate in 2019. In 2020, he founded Paradigm Construction & Development, specializing in acquisitions, investments, development, and investor relations. Off the jobsite, Zach plays rugby for the Indianapolis Impalas and volunteers coaching youth sports. Married to Maddie with three children—Rose, Bo, and Vince—Zach embodies unwavering commitment to family, business, and community, a testament to hard work and perseverance.

Rick Michaelis

Rick Michaelis is a Principal and sponsor of the company, along with being a Managing Member of the Manager (Paradigm Real Estate Management, LLC). Rick is a fourth-generation general contractor deeply rooted in the northside community of Indianapolis. A 2008 graduate of Cathedral High School, Rick earned a management degree from Indiana University, emphasizing city and mixed-use planning. With a background at Michaelis Corp, where he is the fourth generation in his family’s contracting legacy, he transitioned from logistics to hands-on contracting work, specializing in restoration contracting. In the

summer of 2022, Rick joined Paradigm, overseeing construction management, city planning, and permitting work, showcasing his expertise in development and zoning matters. Rick’s leadership extends beyond his professional life; he coached the Broad Ripple Youth Rugby team from 2016 to 2020, leading them to four state titles. Married to Milissa and a dedicated father to their daughter Allie, Rick maintains a robust work-life balance, making him a formidable force in contracting and community development.

Dave Leurck

Dave Leurck is a Principal and sponsor of the company, along with being a Managing Member of the Manager (Paradigm Real Estate Management, LLC). Dave is an experienced business owner and real estate developer with over 30 years of industry experience. Dave attended Miami University and graduated in 1991 with a Bachelor of Arts degree in Business Psychology. He began his career in wealth management in the early ‘90’s and shortly thereafter, started several successful businesses, including — Teller’s of Hyde Park, a successful 25-year restaurant and brewery in Cincinnati. Dave later co-founded Lantrust Real Estate Group that developed multiple mixed-use commercial and residential buildings in Greater Cincinnati and Northern Kentucky. Additionally, Dave co-founded Lantrust Securities, a broker dealer registered with FINRA and oversaw all institutional grade commercial property investments and Reg. D private placement offerings on a national level. Dave recently joined Paradigm in a real estate development role and oversees the Reg. CF and Reg. D offering process for the company. Beyond his professional life, he enjoys the great outdoors, including skiing, hiking, boating and traveling with his family. He is married to Katherine and is a dedicated father to their three children, Andrew, Alexandra, and Audrey. He is and has been active with multiple non-profit organizations, including – Ken Anderson Alliance, Drew’s Rainbows Foundation, and the Karen Wellington Foundation.